The Government of India introduced the Sovereign Gold Bond (SGB) scheme In the Union Budget of 2015-16. To date about 45 SGBs have been issued. Let us for example consider the latest issue ending 5-Feb-21 which has been issued at a price of Rs 4862/- per gram (999 purity). The price on 05-Feb-21 published on the Indian Bullion Jewellers Association website was 4745/- Rs for 999 purity gold. This may have seemed to indicate that purchasing gold in the open market was at-least 117/- Rs cheaper per gram (i.e Rs 4862/- less Rs 4745/-) and hence this Sovereign Gold Bond issue was not an attractive buy.

Interest on SGBs

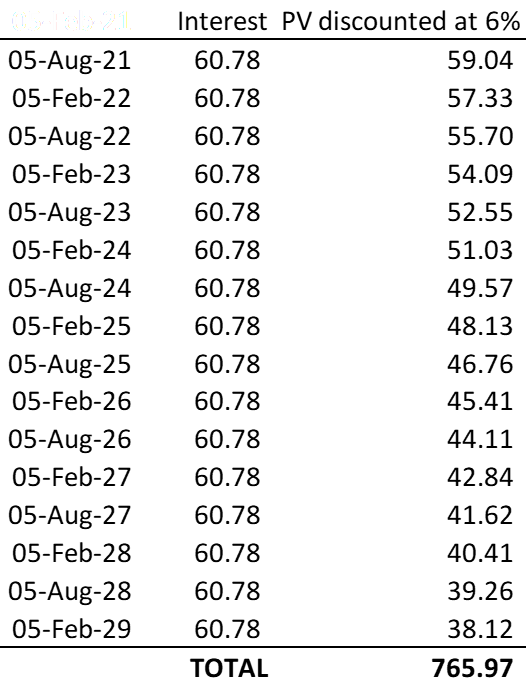

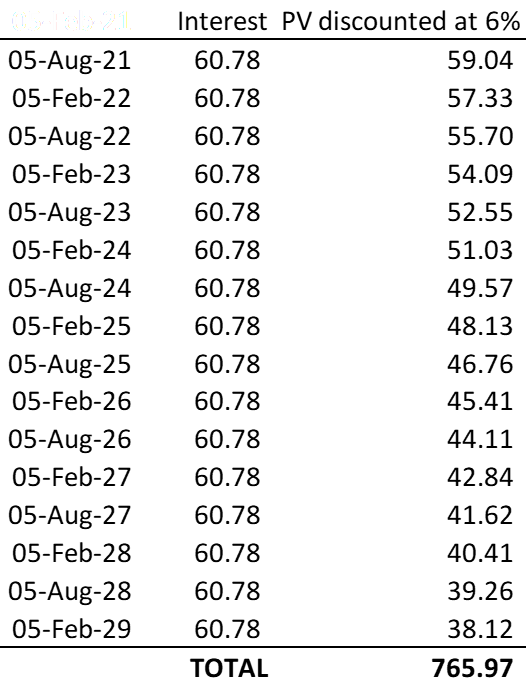

Every SGB issue also has a interest component which is paid on the principal at half yearly rests. The annual interest guaranteed for the latest 5-Feb-21 SGB issue was 2.50%. For the issue under discussion this amounts to Rs 60.78/- (i.e 1.25% of Rs 4862/-) paid every half a year. The pay-out table would look something like this :

The third column indicates the present value of interest discounted at a rate of 6% to today. Our calculation indicates that the total present value of all interest pay-outs from the SGB will be Rs 765.97/-. In other words, in addition to getting one gram of gold at Rs 4862/- we are also getting Rs 765.97/- of interest pay-outs (in today’s value). The effective price of the SGB to us is then Rs 4096.03/- (i.e Rs 4862/- less Rs 765.97/-) . This is at a 14.67% discount to the quoted price of 999 purity gold in the market !!

Tax treatment of SGBs

Clause 15 of the government notification on the SGB scheme states that :

“ The interest on the Gold Bond shall be taxable as per the provisions of the Income Tax Act, 1961 (43 of 1961). The capital gains tax arising on redemption of these bonds to an individual is exempted. The indexation benefits will be provided to long-term capital gains arising to any person on transfer of bond” .

Note the use of the words “redemption” and “transfer” - redemption is not taxable while transfer is taxable. Transfer is when you sell to another party in the secondary market, while redemption is what the Government pays you when you surrender the SGB. The implication is that if held to maturity, the redemption proceeds of the SGB are exempt from Capital Gains Tax. Clause 12 of the notification also mentions the possibility of early redemption after completion of the 5th year of the bond. In other words, at-least theoretically if an investor wishes to take a position in gold and has a minimum 5 year investment horizon, he can avail of the 14.67% discount (will vary on the issue of the SGB) described in the paragraph above and further claim 100% exemption from all Capital Gains on the redemption proceeds of the SGB. No other form of gold (whether gold in its physical bullion form or in the form ETFs) has such an attractive price and tax proposition. As a comparison , gold ETFs and gold bullion have to be purchased at markets rates – so no discount at purchase can availed. Further gold bullion has a storage cost for rental of lockers. To add, the Long Term Capital Gains on sale of gold bullion and gold ETFs are subject to 20% tax with indexation.

Liquidity of SGBs

All SGBs issued are traded in the secondary market and can be bought and sold on NSE and BSE. Though trading does happen, the liquidity is sparse. For example SGBNOV23 – the first SGB issue had a daily trading volume ranging from 4 grams to 482 grams from 5-Jan-21 to 5-Feb-21. Another recent issue SGBAUG28 – in the same time period had a daily trading volume ranging from 901 grams to 22,759 grams. Clearly the daily trading volume does not inspire confidence in liquidity. Gold ETFs however do not suffer from a lack of liquidity.

The conclusion is that, given the high effective discount we get on the Sovereign Gold Bond and its preferential tax treatment on redemption, if an investor does not have liquidity constraints and wishes to take a position in gold with a minimum time horizon of 5 years, the Sovereign Gold Bond Scheme in India currently seems to be by far the best alternative.

Interest on SGBs

Every SGB issue also has a interest component which is paid on the principal at half yearly rests. The annual interest guaranteed for the latest 5-Feb-21 SGB issue was 2.50%. For the issue under discussion this amounts to Rs 60.78/- (i.e 1.25% of Rs 4862/-) paid every half a year. The pay-out table would look something like this :

The third column indicates the present value of interest discounted at a rate of 6% to today. Our calculation indicates that the total present value of all interest pay-outs from the SGB will be Rs 765.97/-. In other words, in addition to getting one gram of gold at Rs 4862/- we are also getting Rs 765.97/- of interest pay-outs (in today’s value). The effective price of the SGB to us is then Rs 4096.03/- (i.e Rs 4862/- less Rs 765.97/-) . This is at a 14.67% discount to the quoted price of 999 purity gold in the market !!

Tax treatment of SGBs

Clause 15 of the government notification on the SGB scheme states that :

“ The interest on the Gold Bond shall be taxable as per the provisions of the Income Tax Act, 1961 (43 of 1961). The capital gains tax arising on redemption of these bonds to an individual is exempted. The indexation benefits will be provided to long-term capital gains arising to any person on transfer of bond” .

Note the use of the words “redemption” and “transfer” - redemption is not taxable while transfer is taxable. Transfer is when you sell to another party in the secondary market, while redemption is what the Government pays you when you surrender the SGB. The implication is that if held to maturity, the redemption proceeds of the SGB are exempt from Capital Gains Tax. Clause 12 of the notification also mentions the possibility of early redemption after completion of the 5th year of the bond. In other words, at-least theoretically if an investor wishes to take a position in gold and has a minimum 5 year investment horizon, he can avail of the 14.67% discount (will vary on the issue of the SGB) described in the paragraph above and further claim 100% exemption from all Capital Gains on the redemption proceeds of the SGB. No other form of gold (whether gold in its physical bullion form or in the form ETFs) has such an attractive price and tax proposition. As a comparison , gold ETFs and gold bullion have to be purchased at markets rates – so no discount at purchase can availed. Further gold bullion has a storage cost for rental of lockers. To add, the Long Term Capital Gains on sale of gold bullion and gold ETFs are subject to 20% tax with indexation.

Liquidity of SGBs

All SGBs issued are traded in the secondary market and can be bought and sold on NSE and BSE. Though trading does happen, the liquidity is sparse. For example SGBNOV23 – the first SGB issue had a daily trading volume ranging from 4 grams to 482 grams from 5-Jan-21 to 5-Feb-21. Another recent issue SGBAUG28 – in the same time period had a daily trading volume ranging from 901 grams to 22,759 grams. Clearly the daily trading volume does not inspire confidence in liquidity. Gold ETFs however do not suffer from a lack of liquidity.

The conclusion is that, given the high effective discount we get on the Sovereign Gold Bond and its preferential tax treatment on redemption, if an investor does not have liquidity constraints and wishes to take a position in gold with a minimum time horizon of 5 years, the Sovereign Gold Bond Scheme in India currently seems to be by far the best alternative.