In a previous blog of 31-Aug-22 we had highlighted the significant advantages a prudent investor could have in taking a position in debt mutual funds over fixed deposits/bonds of a similar risk. The dual advantage of (i) claiming indexation benefits under long term capital gain (LTCG) and (ii) the avoidance of accrual of tax and delaying it to the point of redemption allowed a debt mutual fund investor to theoretically generate a higher tax yield of close to 1.75% per annum over a 10 year period. In an overnight shocker, the Government of India in its wisdom decided to withdraw the indexation benefits of LTCG available to debt mutual funds (for investments made after 31-Mar-23) and to consider all gain irrespective of holding period to be short term capital gain which would be subject to the investors marginal rate of tax.

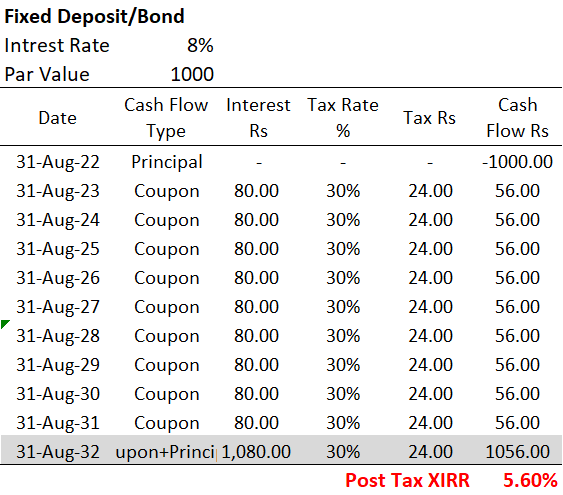

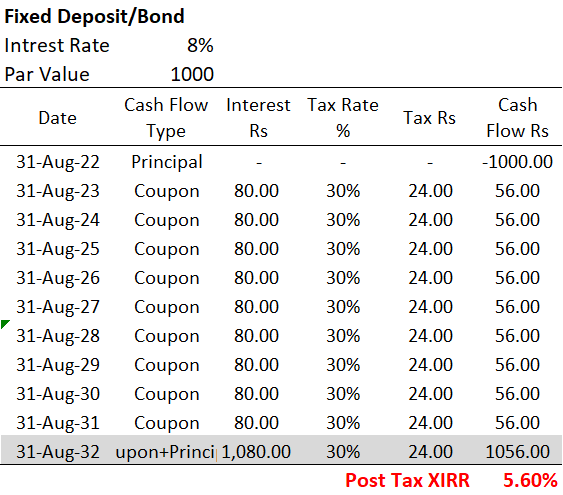

The amended finance bill of 2023 was passed in the Lok Sabha without debate on 24-Mar-23. Investors now have to understand this new tax regime for debt mutual funds and accordingly tailor their post tax return expectations. In light of this we write this blog and try to highlight how the tables presented in our blog of 31-Aug-22 will change. For starters the table shown on fixed deposits does not change and remains identical.

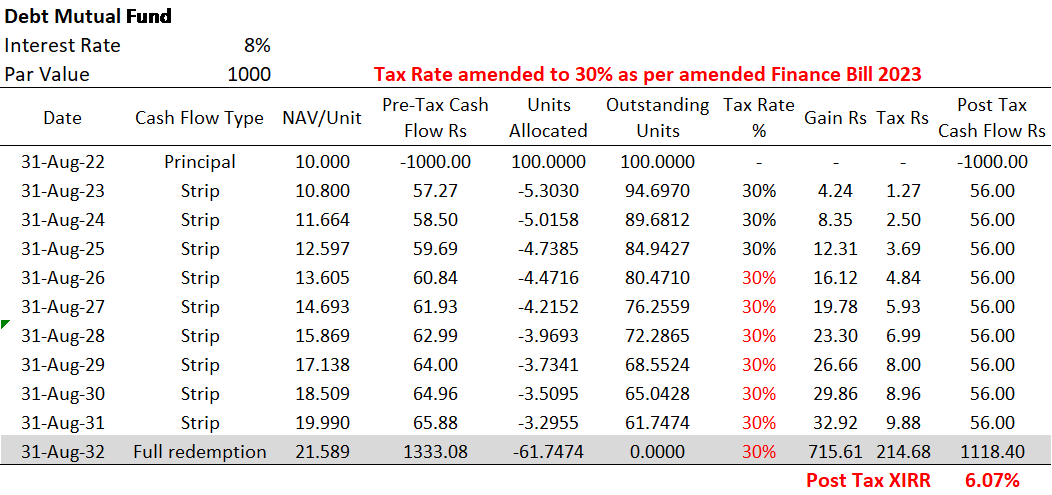

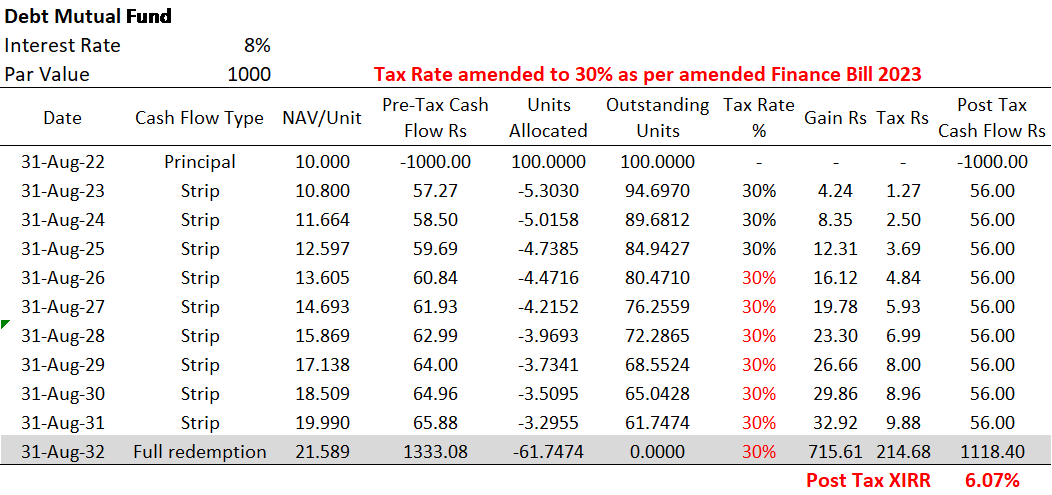

The post tax IRR for a fixed deposit with 8% return as shown in the first table is 5.60%. This is the same as that presented in our earlier blog. On the other hand due to the revocation of indexation benefits of LTCG to debt mutual funds, in second table above the tax rate is modified to 30% uniformly for all redemptions irrespective of holding period. The table indicates that the post tax yield of a debt mutual fund generating a similar pre-tax IRR of 8% with identical post tax stripping cash flow of Rs 56/annum, will now have an IRR of 6.07% - significantly lower than the earlier regime (7.33%) but still a whole 0.47% per annum higher than the post tax yield of a fixed deposit as shown in the first table above.

The post tax yields of debt funds have significantly shrunk as a result of the amendments in the finance bill of 2023. However the avoidance of tax on interest accrual still creates a small but not trivial opportunity for the debt mutual fund to outperform a fixed deposit of similar pre-tax return on a post tax basis.

The amended finance bill of 2023 was passed in the Lok Sabha without debate on 24-Mar-23. Investors now have to understand this new tax regime for debt mutual funds and accordingly tailor their post tax return expectations. In light of this we write this blog and try to highlight how the tables presented in our blog of 31-Aug-22 will change. For starters the table shown on fixed deposits does not change and remains identical.

The post tax IRR for a fixed deposit with 8% return as shown in the first table is 5.60%. This is the same as that presented in our earlier blog. On the other hand due to the revocation of indexation benefits of LTCG to debt mutual funds, in second table above the tax rate is modified to 30% uniformly for all redemptions irrespective of holding period. The table indicates that the post tax yield of a debt mutual fund generating a similar pre-tax IRR of 8% with identical post tax stripping cash flow of Rs 56/annum, will now have an IRR of 6.07% - significantly lower than the earlier regime (7.33%) but still a whole 0.47% per annum higher than the post tax yield of a fixed deposit as shown in the first table above.

The post tax yields of debt funds have significantly shrunk as a result of the amendments in the finance bill of 2023. However the avoidance of tax on interest accrual still creates a small but not trivial opportunity for the debt mutual fund to outperform a fixed deposit of similar pre-tax return on a post tax basis.