While every client is aware of the return generated in her portfolio for the financial year just ended, I would like to take some time to present on how Aroha Capital has performed on a composite portfolio basis. As explained earlier, every client has anyone of the following benchmarks – (a) the low risk State Bank of India one year FD rate or Inflation +2%, (b) the market risk BSE SENSEX Price Index or (c) High risk BSE Small Cap Price Index.

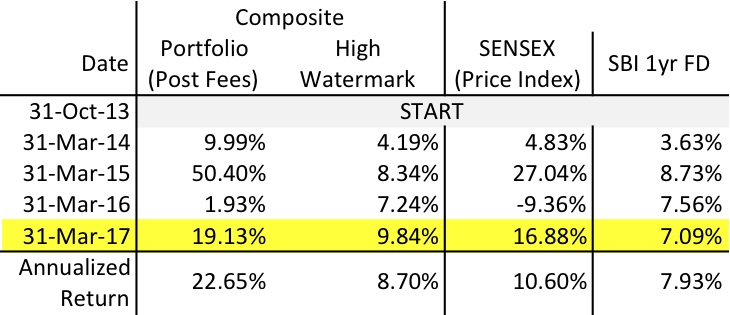

We have completed three and a half years of operation and the results of our advice on client portfolios is given below:

The results presented above are on a post tax basis while the SBI 1 yr FD benchmark return is before taxes. I must however warn the reader that the presentation of the above results are by far not as per international standards and neither are they audited by any third party. They however do attempt to give a fair representation of how we have performed at a composite level.

In last year’s report card we had mentioned that though the low risk portfolios had underperformed their benchmark, they were well positioned for a significant outperformance. This has indeed panned out and client portfolios with low risk benchmarks have net asset values well above their corresponding high watermarks reflecting a healthy level of outperformance. Whether the degree of this outperformance continues remains debatable. Low risk portfolios managed by us are beneficiaries of rises in the index and it is a moot argument whether the market indices such as the BSE SENSEX will continue to rise in the absence of a substantial earnings catch up in the index constituents. Being a skeptic is my preferred option.

Higher risk portfolios benchmarked to the BSE SENSEX and the BSE SMALL CAP INDEX though having done well, have done so at significantly lower levels of outperformance than those witnessed not more than 3 months ago. The relatively large cash positions we have held in these portfolios (`30%) have been a drag mainly because the benchmark indices have raced ahead with very little opportunity for deployment of capital. In-fact in the last two months of the financial year, while high risk portfolios have risen, the benchmark indices have risen much faster, resulting in a squeeze on the large outperformance levels which were being witnessed not more than 3 months ago in these very same portfolios. This is the risk of staying in cash when the market suddenly swings wildly into the positive zone. It is at times like these that the portfolio adviser comes under intense pressure to deploy funds even if fair investible opportunities are not available. The pressure to “catch up” is intense as markets can stay elevated over considerably long periods of time. The times ahead will remain challenging for us if the markets continue to remain awash with liquidity and optimism, leaving us very little opportunity to deploy capital at reasonable valuations for securities for these portfolios.

As is our practice, we continue to insulate client portfolios from catastrophic large draw-downs by having three levels of prudence. The first being controlling allocation to risky assets and maintaining allocation to within client comfort levels. The second being a reasonable price of entry into risky assets and avoiding the momentum game which can be very seductive. The third is through our unique practice of retaining 75% of our fees at risk in client accounts, thus giving a well padded cushion against severe underperformance in the years ahead.

Thank you dear clients for reposing your faith in us. We hope to continue being stewards of your wealth with considerable skin in your game and exposing ourselves to the very same risks that you are exposed to and in that way eat our own cooking.