A client recently purchased a house and had taken a home loan. As usual the client had to also undertake insurance for his home loan. While chosing the appropriate insurance for the home loan, the client was faced with an interesting problem. The client had been given three options to chose from for paying the insurance premium. The client approached us and asked us for our opinion on premium paying option he should chose. The three options offered to the client were as follows :

Option 1: Rinn Raksha

The client makes a one time payment of 17.50 lakh Rs. To reduce the cash out flow burden to the client, this 17 lakh Rs will be loaned to the client at 11.50% interest and will be paid back by the client over the loan period in the form of EMI (Equated Monthly Installments).

Option 2: Smart Swadhan Plus Plan

The client pays a flat premium of 4.25 lakh Rs per annum for the first 5 years. At the end of loan period he will get a 100% cash back of all his premiums paid i.e 4.29 lakh Rs X 5 = 21.25 lakh Rs

Option 3: Smart Shield Plan

The client pays a flat premium of 0.415 lakh Rs per annum for the entire term of the loan with no cash back.

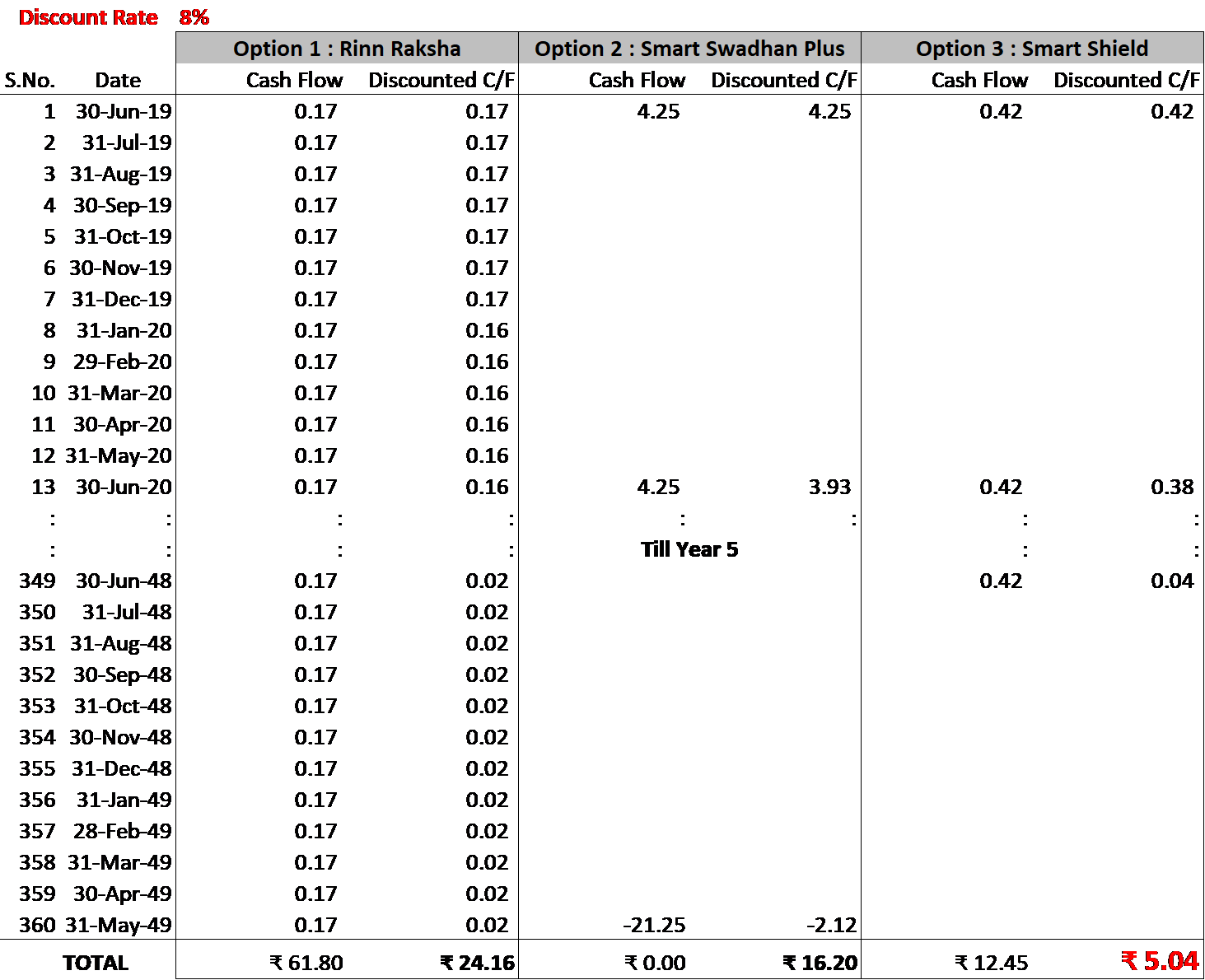

How then should the client organize his thoughts and chose the appropriate premium payment option ? All the cash outflows/inflows are available and it is just a matter of placing these cash flows in a table and discounting them to a present value. The option with the lowest present value will indicate the option with the lowest premium cost – and this is the option to be chosen. The table below has been constructed using the data of the three options, assuming a 30 year loan period and a discount rate of 8% - which is conservative.

The table indicates that the net present value of of the plain vanilla option 3 is the lowest by a far margin, indicating that the client would have significantly overpaid for his home loan insurance if he were to have chosen options 1 or 2. Options 1 and 2 tend to mislead the investor in that either (a) they imply he does not have to put in any money out of his pocket as in option 1 or in that he is getting a cash back of all his paid premiums as in option 2. What is missed is that the future value of money when discounted to today significantly drops as time progresses. In our universe this is the nuts and bolts of of investment advisory. It is what we call low hanging fruit – fruit which we should pluck and leave very little room for error. It is our thesis that it is in applying one's mind to avoiding costly mistakes such as these that the investor gains significantly more than spending too much time in the eternal pursuit of ever increasing portfolio returns.