We are fans of products which have low intermediary charges and low taxes. The drag of intermediary charges and taxes on investments are real and have a significant deleterious impact on the long term returns of investments. One way to reduce intermediary charges is to follow a passive index investing strategy. While passive equity index funds have been available to investors in the Indian financial markets for quite some time now, debt index funds are just about emerging. One such debt index fund series' is the Edelweiss Bharat Bond ETF series which track the NIFTY Bharat Bond Indices. Each series has a target maturity. For example the NIFTY Bharat Bond 2023 index matures in April 2023. On the other hand the NIFTY Bharat Bond 2025 index matures in April 2025 and so on. There will be no intermediate dividend pay-outs. All intermediate coupon payments are re-invested in the underlying bonds and on maturity date, the entire principal plus the accrued gain will be paid out. The indices have been constructed by selecting bonds of AAA rated Government PSUs which will mature around the target maturity of the specific series. For example the NIFTY Bharat Bond 2023 index is constructed from bonds of Government PSUs that will mature around April 2023. Edelweiss, has come out with funds that mimic these indices. Page 22 of the

Edelweiss Fund Fact Sheets .

provide detailed holdings of the fund and the maturity dates of the underlying bonds in considerable detail.

Intermediary costs:

It is a general impression that passive index funds (whether equity or debt) are low cost since the manager has a fixed mandate and no leeway to apply active management. This impression of low cost is further exacerbated by the publishing of something called the Total Expense Ratio in fund fact sheets. The Edelweiss fund’s fact sheets claim an expense ratio of 0.0005% for the Bharat Bond ETFs and 0.05% for the Bharat Bond Fund of Funds (FoFs). However, as we alluded to in a previous blog, there is nothing “total” in the Total Expense Ratio (TER). We must dig deeper to understand the real impact to investors in Bharat Bond Fund (ETFs or FoFs). We have done a preliminary check on the Tracking Difference in the Bharat Bond FoFs/ETFs. The table below has the details as of 7-May-2021:

The Bharat Bond 2023 and 2030 ETFs/FoFs have been in operation since Jan 2020 (about 16 months). On the other hand the Bharat Bond 2025 and 2031 ETFs/FoFs have been in operation since Aug 2020 (less than a year). The short history of these funds makes estimation of Tracking Difference prone to error. This is particularly true for the Bharat Bond 2025 and 2031 ETFs/FoFs which have been in operation for barely 9 months. Taking only the Bharat Bond 2023 and 2030 series into consideration, we estimate that on an annualized basis these FoFs/ETFs will lag their benchmark by about 0.7%. As an upper bound however, it may be prudent to shave off 1% on an annualized basis from the indicated yields at the time of purchase. This is quite high for an Index FoF / ETF. Note the huge discrepancy between Expense Ratio of 0.0005% declared on the fund fact sheet and an actual lag of 1% per annum experienced by the investor. The difference between the two is essentially the trading costs of the funds that are not explicitly taken into account in the Expense Ratio.

Tax treatment:

In a previous blog we have argued that the preferable Long Term Capital Gains tax rate (10% on gain without indexation) makes debt funds attractive compared to Fixed Deposits or plain vanilla bonds – especially for investors in the highest tax bracket. It thus seems that the tax treatment of the Edelweiss Bharat Bond ETFs are favourable and meet the cut.

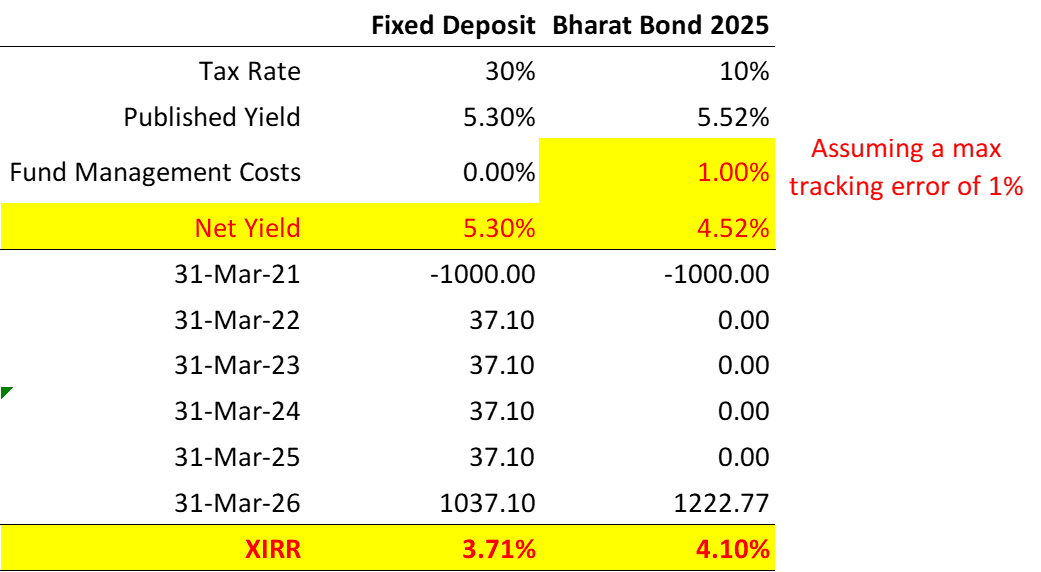

The current going rate of interest for a 4 year Fixed Deposit in the State Bank of India is 5.30%. The post-tax yield for an investor in the highest tax bracket for this Fixed Deposit comes to be 3.71%. The current Bharat Bond 2025 ETF/FoF yield as of 14-May-21 is 5.52%. Taking into account the Tracking Difference of ~1%, this yield has to be reduced to 4.52%. Further after applying the Long Term Capital Gains tax of 10%, the post-tax yield of the Bharat Bond 2025 ETF/FoF works out to be 4.10%- which is about 40 basis point (0.4%) higher than the Fixed Deposit. The table below provides details of our calculations:

We conclude that from a cost perspective, the Edelweiss Bharat Bond ETF/FoF is a mixed bag. - low tax impact, but non-trivial fund management costs. The cumulative impact at current yields indicates that it may still be preferable to be invested in the Bharat Bond 2025 ETF/FoF vs a Fixed Deposit of comparable tenure. However this preference gets significantly eroded or even reversed, if yields drop and/or the tracking difference increases beyond 1%.

Safety:

Fixed income as an investment instrument has limited upside (max upside is the interest) and an unlimited downside (default on interest and principal). It is thus imperative, that investors clearly understand the credit risk (risk of default) involved in debt. The underlying portfolio of the Bharat Bond ETFs are AAA rated bonds of Government of India PSUs. We can keep aside the AAA rating – we know how notoriously fragile these ratings are. However the fact that the bonds are issued by Government of India Public Sector Units (PSUs), implies there is a quasi-sovereign rating on these bonds. A default by any Government of India PSU will be at the cost of enormous economic and political capital –which any political dispensation at the centre will not want at its doorstep. In our opinion PSU bonds fall under the “TOO LARGE/TOO IMPORTANT TO FAIL” category. Our interpretation is that the likelihood of default is similar to the likelihood of default of Government of India paper. However, if one is uncomfortable even with this level of default risk, then it will be wise to stay away.

Fixed Term as a Unique feature:

Risk averse investors tend to park their funds in Fixed Deposits. They are comfortable with the predictable pay out (principal + interest) at the end of the Fixed Deposit term. Both the term and the pay-out of a Fixed Deposit are certain. Debt Mutual Funds on the other hand tend to be open ended (Of-course FMPs have a fixed term and require a separate discussion). There is no fixed term and no certainty on the pay-out at the end of the expected investment time horizon of the investor. This uncertainty significantly reduces the attractiveness of debt funds for risk averse investors who are used to Fixed Deposits. This is in-spite of debt funds having a significantly more attractive tax treatment. The Bharat Bond Index is a unique construct in that it has a fixed term and relatively certain pay-out at the end of its term. While doing our research we came across a blog that discouraged investing in the Bharat Bond indices. One of the key criticisms in the blog was that the pay-out at the end of the fixed term was not as certain as it was being made out to be. The argument was that for the pay-out to be certain, the periodic coupon pay-outs of the various underlying bonds of the ETF will need to be reinvested at yields identical to that which existed at the initial issue of the ETF. This is an interesting point that will be further examined in the next paragraph. Keeping this point aside, if one were to compare a Fixed Deposit to a Bharat Bond ETF of identical term, the Bharat Bond ETF will trump the Fixed Deposit. The referred blog also talks about the superiority of normal open debt funds being able to generate higher returns due to flexibility available for the fund manager. This is true, however for an investor seeking safety similar to a Fixed Deposit and certainty of term and pay-out at the end of the term, we believe the Bharat Bond ETF is uniquely appropriate.

Uncertainty in pay-out:

While the term of the Bharat Bond indices are certain and the maturity date is fixed, there remains uncertainty around the pay-out at the point of maturity. Any ETF that tries to mimic the Bharat Bond index will need to reinvest coupon pay-outs from the underlying bonds again proportionately into the very same bonds. However these bonds are unlikely to be available at prices with an implied yield that was available at the time of issue of the ETF. We thus have some uncertainty around the final maturity pay-out of the ETF.

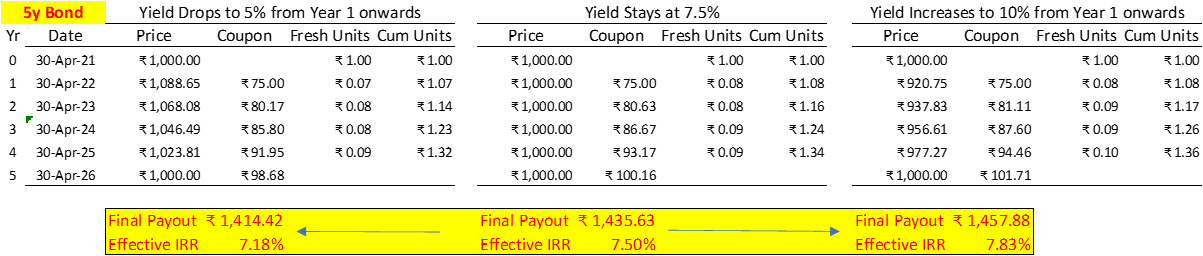

We will now try to assess the variability in pay-out at the point of maturity. For simplicity sake let us consider a single 5 year bond being issued at par (Rs 1000/-) with a coupon of 75 Rs paid out annually. The internal rate of return (IRR) of the bond works out to be 7.5% at start. In the real world yields fluctuate and it is not reasonable to expect yields to remain constant. We will consider two extreme case scenarios. In the first we will assume, that just after issue, the yields drop to 5% (and bond price rises) and remain so till the end of the bond term. In the second we will assume that just after issue, yields rise to 10% (and bond price drops) and remain so till the end of the bond term. This is presented in the tables below for both the 5 year and 10 year bond.

In the first table above, the 5y bond was expected to have a pay-out of Rs 1435.63/- after 5 years assuming yields remained at 7.5% throughout the 5 year term. In a scenario of yields dropping to 5%, the pay-out after 5 years would be Rs 1414.42/-. The IRR of the investment would then drop from 7.5% to 7.18%. This actually is a great outcome since we have achieved a yield of 7.18% versus a yield of 5.0% which existed for 4 of the 5 years of the life of the bond. On the other hand in a scenario of yields rising to 10%, the pay-out after 5 years would be Rs 1457.88/-. The IRR of investment would then increase from 7.5% to 7.83% - sub-par compared to the 10% yield that existed for 4 out of 5 years of the life of the bond – nevertheless still better than a comparable FD. Another way to look at this uncertainty is to say that the final pay-out will be in the range of Rs +/- 3% of Rs 1435.63 (the predicted pay-out based on the yield at the point of purchase). We would think a +/-3% uncertainty is acceptable – though this is open to interpretation.

There is one more uncertainty in the final pay-out, which we have not yet been able to get clarity on. In a paper published by NSE on the methodology adopted for the index, the following is stated on page 5 of the document under the section Index rebalancing/reconstitution :

In the last year of maturity of each index in the series (i.e. during the twelve months period prior to the maturity date of the corresponding index), any proceeds from bond redemption prior to the maturity date of such index shall be re-invested in the T-Bill maturing on or just before the index maturity date as identified on the redemption date of the first bond. In case the T-Bill, in which the proceeds from bond redemption have been reinvested, matures before the index maturity date, the redemption proceeds of such T-Bill shall be re-invested in The Clearing Corporation of India Ltd.’s (CCIL) TREPS overnight rate for subsequent days till the maturity of the index

In our discussions with Edelweiss on this matter, they said that the YTM (Yield To Maturity) published on a daily basis for Bharat Bonds is based on standard YTM calculation procedures and that the YTM will not be the return experienced by the investor. In other words, in the 12 motnhs preceeding the maturity of a Bharat Bond, the matured proceeds/coupons of the underlying bonds are likely to be re-invested in T-bills/Overnight paper - which will mean that there is likely to be a further drop in returns. In other words even if the yields were to remain constant, the YTM published is surely the upper bound of the returns that an investor is likely to experience.

The primary downside of the Bharat Bond index is the lack of flexibility once yields rise. If interest rates rise, the investor is locked into an investment at lower yields and thus runs the risk of generating returns lower than inflation. Our argument is that the investor has given up this flexibility for securing more certainty around his final pay-out. Based on the above discussion, we think it may be prudent to hold Bharat Bond ETFs/FoFs which have a minimum of 3 years and maximum of 5 years to maturity. – so that (a) an investor can make use of the preferential long term capital gains tax (>3 years) of 10% (b) keep the uncertainty in final maturity pay-out to minimum(about +/-3%) (c) keep exposure to long dated securities (>5 years) to a minimum to reduce duration risk (ie risk of interest rates rising in the future). Our view may change based on the evolving tracking difference in Edelweiss Bharat Bond ETFs in the years ahead.

Intermediary costs:

It is a general impression that passive index funds (whether equity or debt) are low cost since the manager has a fixed mandate and no leeway to apply active management. This impression of low cost is further exacerbated by the publishing of something called the Total Expense Ratio in fund fact sheets. The Edelweiss fund’s fact sheets claim an expense ratio of 0.0005% for the Bharat Bond ETFs and 0.05% for the Bharat Bond Fund of Funds (FoFs). However, as we alluded to in a previous blog, there is nothing “total” in the Total Expense Ratio (TER). We must dig deeper to understand the real impact to investors in Bharat Bond Fund (ETFs or FoFs). We have done a preliminary check on the Tracking Difference in the Bharat Bond FoFs/ETFs. The table below has the details as of 7-May-2021:

The Bharat Bond 2023 and 2030 ETFs/FoFs have been in operation since Jan 2020 (about 16 months). On the other hand the Bharat Bond 2025 and 2031 ETFs/FoFs have been in operation since Aug 2020 (less than a year). The short history of these funds makes estimation of Tracking Difference prone to error. This is particularly true for the Bharat Bond 2025 and 2031 ETFs/FoFs which have been in operation for barely 9 months. Taking only the Bharat Bond 2023 and 2030 series into consideration, we estimate that on an annualized basis these FoFs/ETFs will lag their benchmark by about 0.7%. As an upper bound however, it may be prudent to shave off 1% on an annualized basis from the indicated yields at the time of purchase. This is quite high for an Index FoF / ETF. Note the huge discrepancy between Expense Ratio of 0.0005% declared on the fund fact sheet and an actual lag of 1% per annum experienced by the investor. The difference between the two is essentially the trading costs of the funds that are not explicitly taken into account in the Expense Ratio.

Tax treatment:

In a previous blog we have argued that the preferable Long Term Capital Gains tax rate (10% on gain without indexation) makes debt funds attractive compared to Fixed Deposits or plain vanilla bonds – especially for investors in the highest tax bracket. It thus seems that the tax treatment of the Edelweiss Bharat Bond ETFs are favourable and meet the cut.

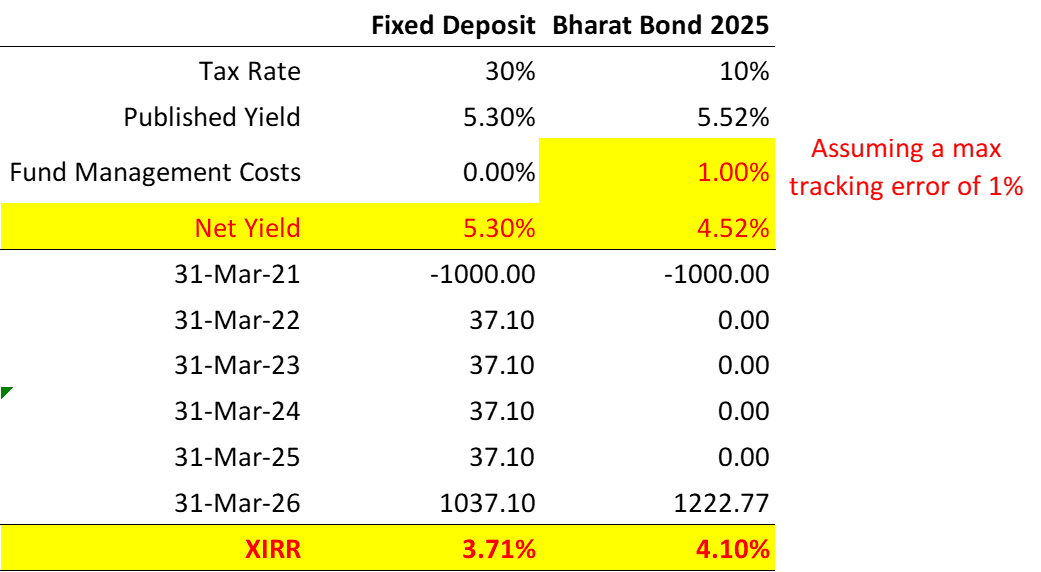

The current going rate of interest for a 4 year Fixed Deposit in the State Bank of India is 5.30%. The post-tax yield for an investor in the highest tax bracket for this Fixed Deposit comes to be 3.71%. The current Bharat Bond 2025 ETF/FoF yield as of 14-May-21 is 5.52%. Taking into account the Tracking Difference of ~1%, this yield has to be reduced to 4.52%. Further after applying the Long Term Capital Gains tax of 10%, the post-tax yield of the Bharat Bond 2025 ETF/FoF works out to be 4.10%- which is about 40 basis point (0.4%) higher than the Fixed Deposit. The table below provides details of our calculations:

We conclude that from a cost perspective, the Edelweiss Bharat Bond ETF/FoF is a mixed bag. - low tax impact, but non-trivial fund management costs. The cumulative impact at current yields indicates that it may still be preferable to be invested in the Bharat Bond 2025 ETF/FoF vs a Fixed Deposit of comparable tenure. However this preference gets significantly eroded or even reversed, if yields drop and/or the tracking difference increases beyond 1%.

Safety:

Fixed income as an investment instrument has limited upside (max upside is the interest) and an unlimited downside (default on interest and principal). It is thus imperative, that investors clearly understand the credit risk (risk of default) involved in debt. The underlying portfolio of the Bharat Bond ETFs are AAA rated bonds of Government of India PSUs. We can keep aside the AAA rating – we know how notoriously fragile these ratings are. However the fact that the bonds are issued by Government of India Public Sector Units (PSUs), implies there is a quasi-sovereign rating on these bonds. A default by any Government of India PSU will be at the cost of enormous economic and political capital –which any political dispensation at the centre will not want at its doorstep. In our opinion PSU bonds fall under the “TOO LARGE/TOO IMPORTANT TO FAIL” category. Our interpretation is that the likelihood of default is similar to the likelihood of default of Government of India paper. However, if one is uncomfortable even with this level of default risk, then it will be wise to stay away.

Fixed Term as a Unique feature:

Risk averse investors tend to park their funds in Fixed Deposits. They are comfortable with the predictable pay out (principal + interest) at the end of the Fixed Deposit term. Both the term and the pay-out of a Fixed Deposit are certain. Debt Mutual Funds on the other hand tend to be open ended (Of-course FMPs have a fixed term and require a separate discussion). There is no fixed term and no certainty on the pay-out at the end of the expected investment time horizon of the investor. This uncertainty significantly reduces the attractiveness of debt funds for risk averse investors who are used to Fixed Deposits. This is in-spite of debt funds having a significantly more attractive tax treatment. The Bharat Bond Index is a unique construct in that it has a fixed term and relatively certain pay-out at the end of its term. While doing our research we came across a blog that discouraged investing in the Bharat Bond indices. One of the key criticisms in the blog was that the pay-out at the end of the fixed term was not as certain as it was being made out to be. The argument was that for the pay-out to be certain, the periodic coupon pay-outs of the various underlying bonds of the ETF will need to be reinvested at yields identical to that which existed at the initial issue of the ETF. This is an interesting point that will be further examined in the next paragraph. Keeping this point aside, if one were to compare a Fixed Deposit to a Bharat Bond ETF of identical term, the Bharat Bond ETF will trump the Fixed Deposit. The referred blog also talks about the superiority of normal open debt funds being able to generate higher returns due to flexibility available for the fund manager. This is true, however for an investor seeking safety similar to a Fixed Deposit and certainty of term and pay-out at the end of the term, we believe the Bharat Bond ETF is uniquely appropriate.

Uncertainty in pay-out:

While the term of the Bharat Bond indices are certain and the maturity date is fixed, there remains uncertainty around the pay-out at the point of maturity. Any ETF that tries to mimic the Bharat Bond index will need to reinvest coupon pay-outs from the underlying bonds again proportionately into the very same bonds. However these bonds are unlikely to be available at prices with an implied yield that was available at the time of issue of the ETF. We thus have some uncertainty around the final maturity pay-out of the ETF.

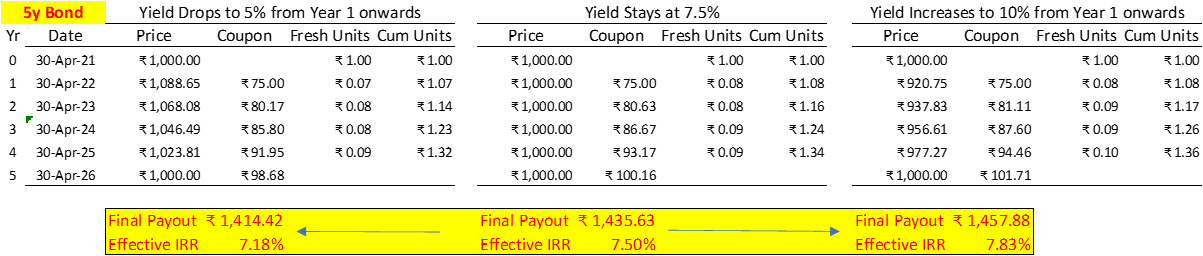

We will now try to assess the variability in pay-out at the point of maturity. For simplicity sake let us consider a single 5 year bond being issued at par (Rs 1000/-) with a coupon of 75 Rs paid out annually. The internal rate of return (IRR) of the bond works out to be 7.5% at start. In the real world yields fluctuate and it is not reasonable to expect yields to remain constant. We will consider two extreme case scenarios. In the first we will assume, that just after issue, the yields drop to 5% (and bond price rises) and remain so till the end of the bond term. In the second we will assume that just after issue, yields rise to 10% (and bond price drops) and remain so till the end of the bond term. This is presented in the tables below for both the 5 year and 10 year bond.

In the first table above, the 5y bond was expected to have a pay-out of Rs 1435.63/- after 5 years assuming yields remained at 7.5% throughout the 5 year term. In a scenario of yields dropping to 5%, the pay-out after 5 years would be Rs 1414.42/-. The IRR of the investment would then drop from 7.5% to 7.18%. This actually is a great outcome since we have achieved a yield of 7.18% versus a yield of 5.0% which existed for 4 of the 5 years of the life of the bond. On the other hand in a scenario of yields rising to 10%, the pay-out after 5 years would be Rs 1457.88/-. The IRR of investment would then increase from 7.5% to 7.83% - sub-par compared to the 10% yield that existed for 4 out of 5 years of the life of the bond – nevertheless still better than a comparable FD. Another way to look at this uncertainty is to say that the final pay-out will be in the range of Rs +/- 3% of Rs 1435.63 (the predicted pay-out based on the yield at the point of purchase). We would think a +/-3% uncertainty is acceptable – though this is open to interpretation.

There is one more uncertainty in the final pay-out, which we have not yet been able to get clarity on. In a paper published by NSE on the methodology adopted for the index, the following is stated on page 5 of the document under the section Index rebalancing/reconstitution :

In the last year of maturity of each index in the series (i.e. during the twelve months period prior to the maturity date of the corresponding index), any proceeds from bond redemption prior to the maturity date of such index shall be re-invested in the T-Bill maturing on or just before the index maturity date as identified on the redemption date of the first bond. In case the T-Bill, in which the proceeds from bond redemption have been reinvested, matures before the index maturity date, the redemption proceeds of such T-Bill shall be re-invested in The Clearing Corporation of India Ltd.’s (CCIL) TREPS overnight rate for subsequent days till the maturity of the index

In our discussions with Edelweiss on this matter, they said that the YTM (Yield To Maturity) published on a daily basis for Bharat Bonds is based on standard YTM calculation procedures and that the YTM will not be the return experienced by the investor. In other words, in the 12 motnhs preceeding the maturity of a Bharat Bond, the matured proceeds/coupons of the underlying bonds are likely to be re-invested in T-bills/Overnight paper - which will mean that there is likely to be a further drop in returns. In other words even if the yields were to remain constant, the YTM published is surely the upper bound of the returns that an investor is likely to experience.

The primary downside of the Bharat Bond index is the lack of flexibility once yields rise. If interest rates rise, the investor is locked into an investment at lower yields and thus runs the risk of generating returns lower than inflation. Our argument is that the investor has given up this flexibility for securing more certainty around his final pay-out. Based on the above discussion, we think it may be prudent to hold Bharat Bond ETFs/FoFs which have a minimum of 3 years and maximum of 5 years to maturity. – so that (a) an investor can make use of the preferential long term capital gains tax (>3 years) of 10% (b) keep the uncertainty in final maturity pay-out to minimum(about +/-3%) (c) keep exposure to long dated securities (>5 years) to a minimum to reduce duration risk (ie risk of interest rates rising in the future). Our view may change based on the evolving tracking difference in Edelweiss Bharat Bond ETFs in the years ahead.