Debt investors in India predominantly invest in sovereign bonds, bank and corporate fixed deposits. Citing safety, investors flock towards these fixed income instruments. No doubt, sovereign, high rated bank, NBFC and corporate fixed deposits or bonds are preferable for investors below the taxable threshold. However, for investors in the highest tax bracket the significant impact of tax drag on a fixed deposit or bond investment needs to be taken into account.

Individuals in the highest tax bracket attract a tax rate of 30% on all interest coupons. Not only is this tax rate high, there is also Tax Deducted at Source (TDS) on all interest coupons. Debt mutual funds on the other hand operate within a trust structure. As a result, all transactions that occur within a fund are tax shielded for the investor. An investor in a debt mutual fund is taxed only on the capital gain incurred on redemption. As long as an investor stays invested in the debt mutual fund, even if there are gains in the net asset value of the debt mutual fund, there is no tax or TDS as long as redemption does not occur. This provides two sources of tax arbitrage that the debt fund investor can harness. Let us illustrate through an example below :

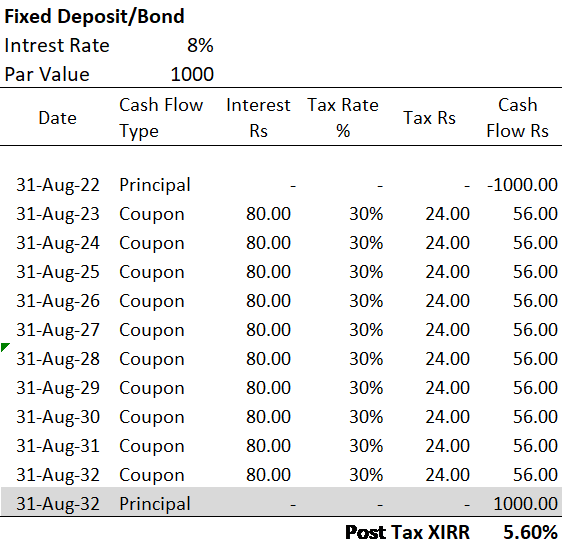

Table 1: Post Tax Cash Flows of a Fixed Deposit/Bond

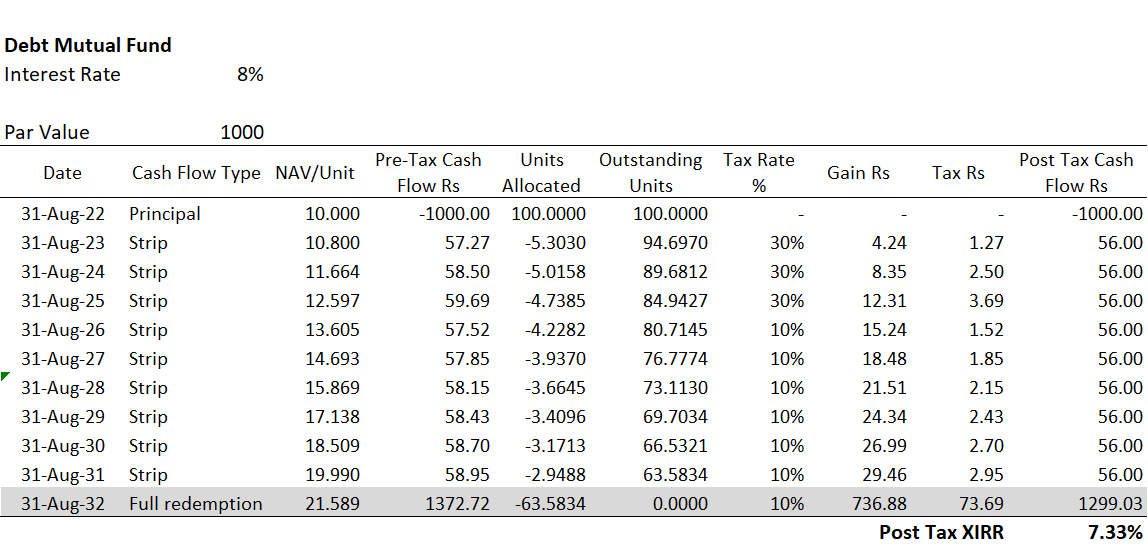

Table 2: Post Tax Cash Flows of a Debt Mutual Fund

In the above two tables we are comparing the post-tax cash flows of a Fixed Deposit/Bond (Table 1) versus those of a Debt Mutual Fud (Table 2). We have kept the invested amount (Rs 1000) and the rate of return (8%) the same. We have also assumed that the investor requires a post-tax cash flow of Rs 56 per annum for the next 10 years and has a marginal income tax rate of 30%.

Difference in tax rates:

A constant 30% tax rate is applied to all coupon payments in table 1 (Fixed Deposit/Bond). This results in a uniform tax outgo of Rs 24 in table 1. On the other hand, the tax rate applied to the gain portion of the stripped out cash flows from the debt mutual fund (table 2) is 30% for the first 3 years and 10% thereafter. This is because gain on redemptions in a debt mutual fund within the first three years is considered Short Term Capital Gain (STCG) taxed at the marginal tax rate of the investor. All redemption gains beyond 3 years are considered Long Term Capital Gains (LTCG) and taxed at 10%. This results in a significantly lower tax rate after 3 years for the debt mutual fund (table 2)

Difference in amount applied to tax:

In table 1 the uniform 30% tax rate is applied to the Rs 80 coupon every year – which results in a uniform Rs 24 of tax every year. On the other hand in table 2, tax is applied only on the gain portion of every strip. For example in year 2, an amount of Rs 57.27 is stripped out of the debt mutual fund. This stripped amount carries with it a gain of Rs 4.24. Only this Rs 4.24 is taxed at the appropriate tax rate of 30% (since it is STCG). Now consider the strip of Rs 58.70 applied on 31-Aug-30. The gain portion of this strip is Rs 26.99 which is taxed at a LTCG rate of 10%. Hence the tax outgo amounts to Rs 2.70. One can notice that the amount applied to tax is significantly lower in the case of Table-2. In-fact, bulk of the gain is deferred to the point of redemption (last line item in Table 2). At full redemption, the redeemed amount is Rs 1372.72 in which the gain is Rs 736.88. As this gain falls under LTCG, a tax rate of 10% is applied making the tax out go Rs 73.68 at redemption.

The cumulative effect of the difference in tax rate and the difference in amounts applied to tax between the two tables results in a massive difference in cash out flows in the final year (i.e cash flow date of 31-Aug-32). While the fixed deposit/bond returns the par value of Rs 1000 to the investor, the debt mutual fund returns Rs 1299.03 after tax to the investor – this is a 30% premium!! This is after both the instruments have paid Rs 56 post tax to the investor over the preceding 9 years. The post tax XIRR of the fixed deposit/bond (Table 1) comes out to be 5.60% while that of the debt mutual fund (Table 2) is 7.33% - a non-trivial difference of 1.73% per annum !!

A further more nuanced point is that in the fixed deposit/bond the investor has no choice. Tax on coupon is guaranteed every year whether the investor collects the coupon or keeps it invested for payout at maturity. On the other hand, the decision on how much to redeem (strip) every year is in the hands of the investor in an open ended debt mutual fund. If for example funds are not required in a given year, the investor can chose not to redeem. In the absence of redemption there is no tax irrespective of the fact that the net asset value of the fund keeps increasing. This optionality in an open ended debt mutual fund is an added advantage.

It may be debated that the risk profile of a debt fund is different from that of a fixed deposit -and yes this needs close attention. Nevertheless, when deciding to invest in a fixed deposit/bond, the investor (particularly those in the highest tax bracket) is advised to search for debt mutual fund instruments of similar risk and then apply the tax arbitrage discussed above. Only after making this assessment should the investor make his decision.

Individuals in the highest tax bracket attract a tax rate of 30% on all interest coupons. Not only is this tax rate high, there is also Tax Deducted at Source (TDS) on all interest coupons. Debt mutual funds on the other hand operate within a trust structure. As a result, all transactions that occur within a fund are tax shielded for the investor. An investor in a debt mutual fund is taxed only on the capital gain incurred on redemption. As long as an investor stays invested in the debt mutual fund, even if there are gains in the net asset value of the debt mutual fund, there is no tax or TDS as long as redemption does not occur. This provides two sources of tax arbitrage that the debt fund investor can harness. Let us illustrate through an example below :

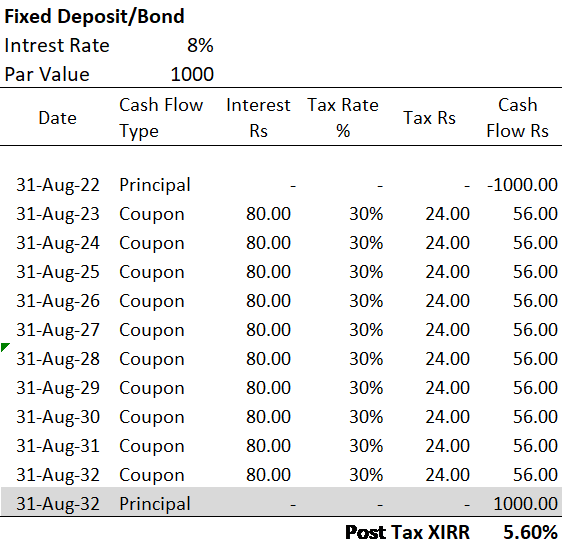

Table 1: Post Tax Cash Flows of a Fixed Deposit/Bond

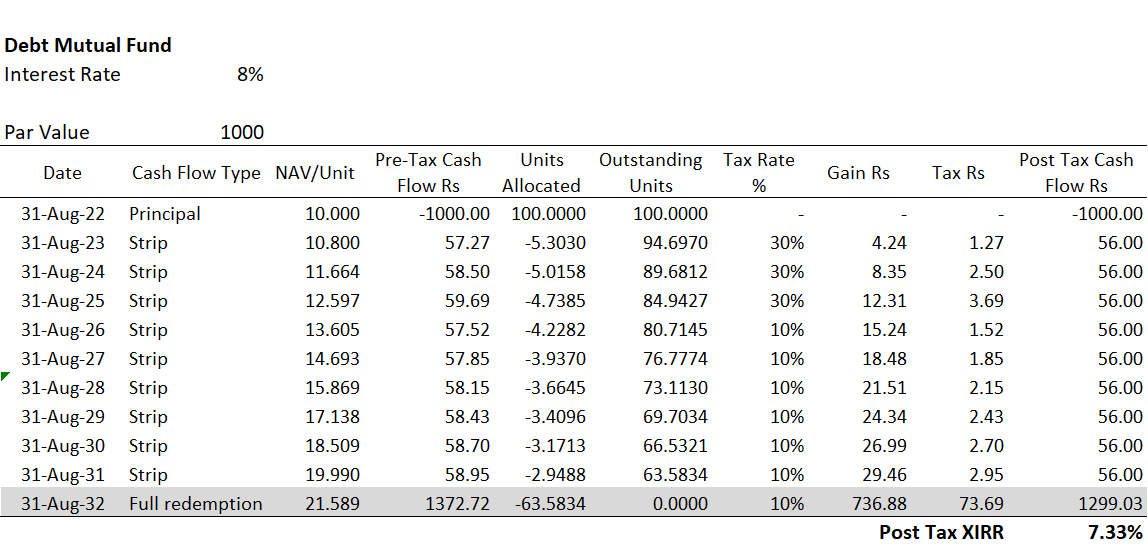

Table 2: Post Tax Cash Flows of a Debt Mutual Fund

In the above two tables we are comparing the post-tax cash flows of a Fixed Deposit/Bond (Table 1) versus those of a Debt Mutual Fud (Table 2). We have kept the invested amount (Rs 1000) and the rate of return (8%) the same. We have also assumed that the investor requires a post-tax cash flow of Rs 56 per annum for the next 10 years and has a marginal income tax rate of 30%.

Difference in tax rates:

A constant 30% tax rate is applied to all coupon payments in table 1 (Fixed Deposit/Bond). This results in a uniform tax outgo of Rs 24 in table 1. On the other hand, the tax rate applied to the gain portion of the stripped out cash flows from the debt mutual fund (table 2) is 30% for the first 3 years and 10% thereafter. This is because gain on redemptions in a debt mutual fund within the first three years is considered Short Term Capital Gain (STCG) taxed at the marginal tax rate of the investor. All redemption gains beyond 3 years are considered Long Term Capital Gains (LTCG) and taxed at 10%. This results in a significantly lower tax rate after 3 years for the debt mutual fund (table 2)

Difference in amount applied to tax:

In table 1 the uniform 30% tax rate is applied to the Rs 80 coupon every year – which results in a uniform Rs 24 of tax every year. On the other hand in table 2, tax is applied only on the gain portion of every strip. For example in year 2, an amount of Rs 57.27 is stripped out of the debt mutual fund. This stripped amount carries with it a gain of Rs 4.24. Only this Rs 4.24 is taxed at the appropriate tax rate of 30% (since it is STCG). Now consider the strip of Rs 58.70 applied on 31-Aug-30. The gain portion of this strip is Rs 26.99 which is taxed at a LTCG rate of 10%. Hence the tax outgo amounts to Rs 2.70. One can notice that the amount applied to tax is significantly lower in the case of Table-2. In-fact, bulk of the gain is deferred to the point of redemption (last line item in Table 2). At full redemption, the redeemed amount is Rs 1372.72 in which the gain is Rs 736.88. As this gain falls under LTCG, a tax rate of 10% is applied making the tax out go Rs 73.68 at redemption.

The cumulative effect of the difference in tax rate and the difference in amounts applied to tax between the two tables results in a massive difference in cash out flows in the final year (i.e cash flow date of 31-Aug-32). While the fixed deposit/bond returns the par value of Rs 1000 to the investor, the debt mutual fund returns Rs 1299.03 after tax to the investor – this is a 30% premium!! This is after both the instruments have paid Rs 56 post tax to the investor over the preceding 9 years. The post tax XIRR of the fixed deposit/bond (Table 1) comes out to be 5.60% while that of the debt mutual fund (Table 2) is 7.33% - a non-trivial difference of 1.73% per annum !!

A further more nuanced point is that in the fixed deposit/bond the investor has no choice. Tax on coupon is guaranteed every year whether the investor collects the coupon or keeps it invested for payout at maturity. On the other hand, the decision on how much to redeem (strip) every year is in the hands of the investor in an open ended debt mutual fund. If for example funds are not required in a given year, the investor can chose not to redeem. In the absence of redemption there is no tax irrespective of the fact that the net asset value of the fund keeps increasing. This optionality in an open ended debt mutual fund is an added advantage.

It may be debated that the risk profile of a debt fund is different from that of a fixed deposit -and yes this needs close attention. Nevertheless, when deciding to invest in a fixed deposit/bond, the investor (particularly those in the highest tax bracket) is advised to search for debt mutual fund instruments of similar risk and then apply the tax arbitrage discussed above. Only after making this assessment should the investor make his decision.