It is said that a retiring individual would require a corpus of about 30X one’s annual expense. This useful rule of thumb, however presents an innocuous picture of a complex problem that has multiple assumptions and constraints. Solving the problem of retirement is essentially establishing a corpus that needs to be built so that the retiree can reasonably maintain her lifestyle over her lifetime. To solve this problem, at minimum the following questions need to be asked :

Age at Retirement and Life Expectancy:

To be conservative it may be appropriate to assume the individual lives till age 90 irrespective of health. We will allow the age of retirement to be kept as a variable to be toggled with for the prospective retiree.

Expenses in Retirement:

The answer to question (c) is complex. A 50 year old retiree may wish to build in expenses for travel and eating out and may underestimate medical costs which creep in later in life. On the other hand an older retiree may not wish to travel but also have higher medical expenses. We feel the answer to this question is prudently answered closer to retirement rather than much earlier – simply because circumstances and people change. One can circumvent this problem by trying to answer the question every year – ie what are my current annual expenses ? – at my current annual expenses and my current age, do I have a corpus that is sufficient for me to retire today?

Inflation:

Question (d) on inflation is not trivial. Inflation has a huge impact on projecting future expenses. A reduction in inflation assumption from 6% to 2% drops expenses 30 years into the future to 1/3rd !! As future expenses are significantly impacted by inflation, a prudent approach would be to assume inflation in India at 6% - which is the upper limit for the 2% to 6% inflation target band given to the Reserve Bank of India. This is not to say that the RBI’s independence from the Government of India can be taken for granted nor should it be assumed that the RBI will always have enough arsenal in its reserves to keep a tab on inflation within this band. 6% though conservative should be taken with a bit of salt.

Risk-Return assumptions of the Retirement Portfolio:

Question (e) on the risk-return assumptions of the retirement portfolio are intimately connected with two further questions –(1) return expectation on debt and equity and (2) what mix of debt and equity the retirement portfolio will have. To answer question 1, we turn to the current macro-economic conditions in India. A curious case of negative real returns for debt investments post tax exists today. A one year bank fixed deposit for an individual in the highest tax bracket would yield about 3.5% interest post tax - a full 2.5% below current inflation. It may be argued that yield on debt investments can be increased by purchasing lower rated debt paper – however this assumes taking on credit risk entering uncomfortable territory. Yield could also be pushed up by buying long duration sovereign paper – however mark to market risks can be high in long duration paper due to interest rate fluctuations. It may also be argued that the current scenario of negative real returns on debt may not last for long. Our approach is nevertheless to err on the side of caution and assume a debt return of 3.5% post tax. Our assumption for equity returns is based on the assumption that the long term growth rate of the Indian economy will be 6% + 6% inflation – which would bring equity returns to 12%. We shave off 1% for taxes and keep a further cushion of 1% - making our assumption on returns in equity at 10%.

To obtain the overall return of the retirement portfolio – it is required to establish what mix of debt and equity the retirement portfolio is to have. Higher debt allocation makes the portfolio safer – however long term returns get affected since debt returns are just 3.5%. Equity returns ensure a higher long term return of 10% which however come with significant drawdown risks in the short term - making the overall portfolio riskier. It is also likely that the mix of equity and debt will not be constant through the lifetime of the corpus. How then do we judiciously allocate between equity and debt through the lifetime of the retirement corpus? Retirement portfolios face two risks – the first risk is the inability of the corpus to last over the lifetime of the retiree and the second is the short-term mark to market fluctuations in the portfolio due to drawdowns in risky equity. It is clear that the % allocation to equity is unlikely to remain the same over the life of the retirement corpus. It is more likely that exposure to equity would initially be higher and then would taper down as the retiree age nears 90. We feel a more intuitive way to tackle this issue is to a-priori decide how many years of forward expenses the retiree wants to lock into debt. A very risk averse retiree may want to lock-in 15 years of forward expenses in debt while a more adventurous retiree may feel comfortable with only 5 years of forward expenses in debt. Do note that there is a trade-off – the more years of forward expenses locked in safe debt investments gives lesser room for exposure to equity – reducing long term returns and hence the overall return expectations of the portfolio – and thereby dropping the maximum term over which the retirement corpus can last. The number of years of forward expenses to be locked into debt is a personal choice to be made by each retiree. We will allow for this personal choice by providing a range. The retiree can chose where he wishes to be in this range.

Solving the retirement problem:

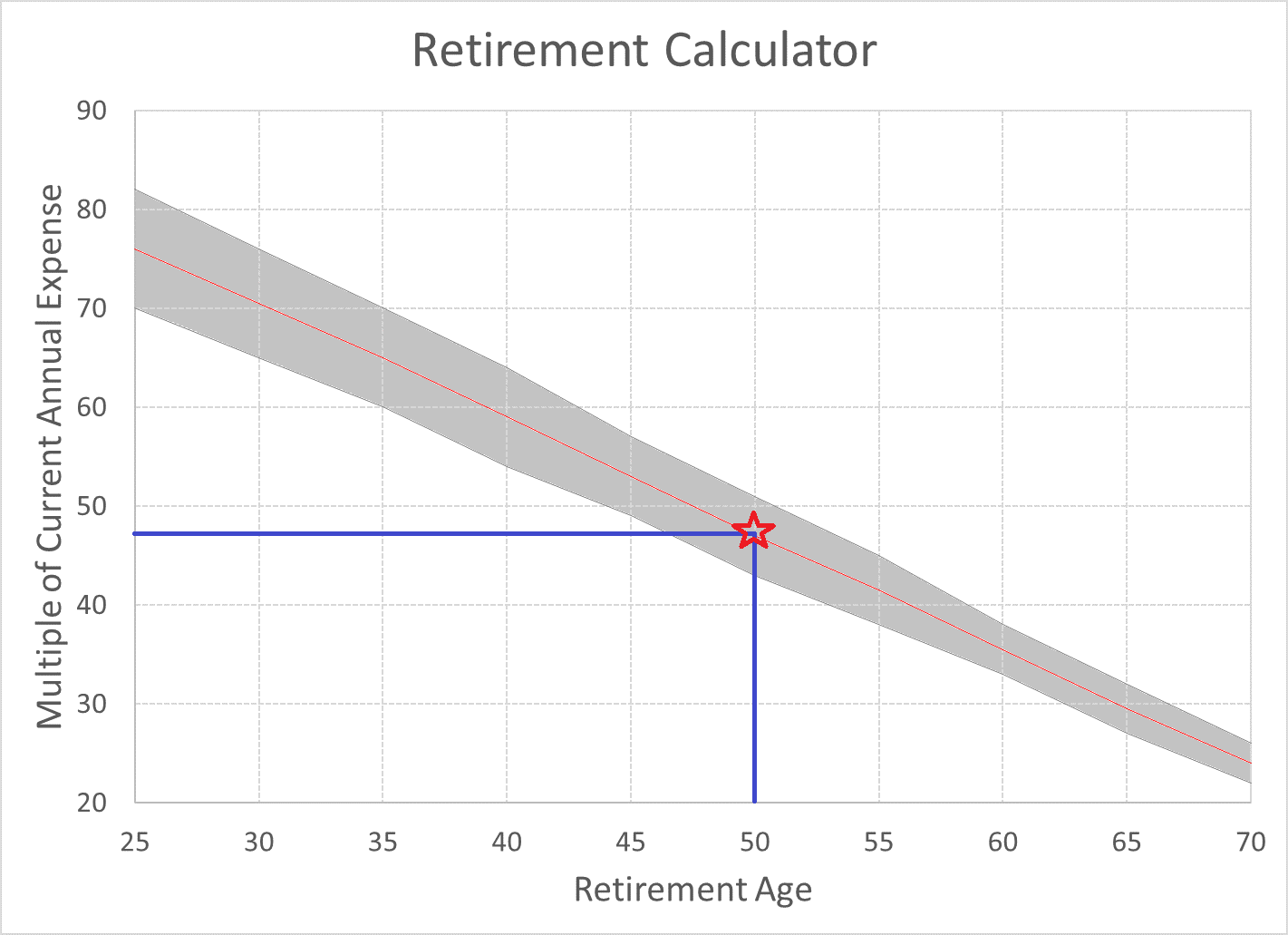

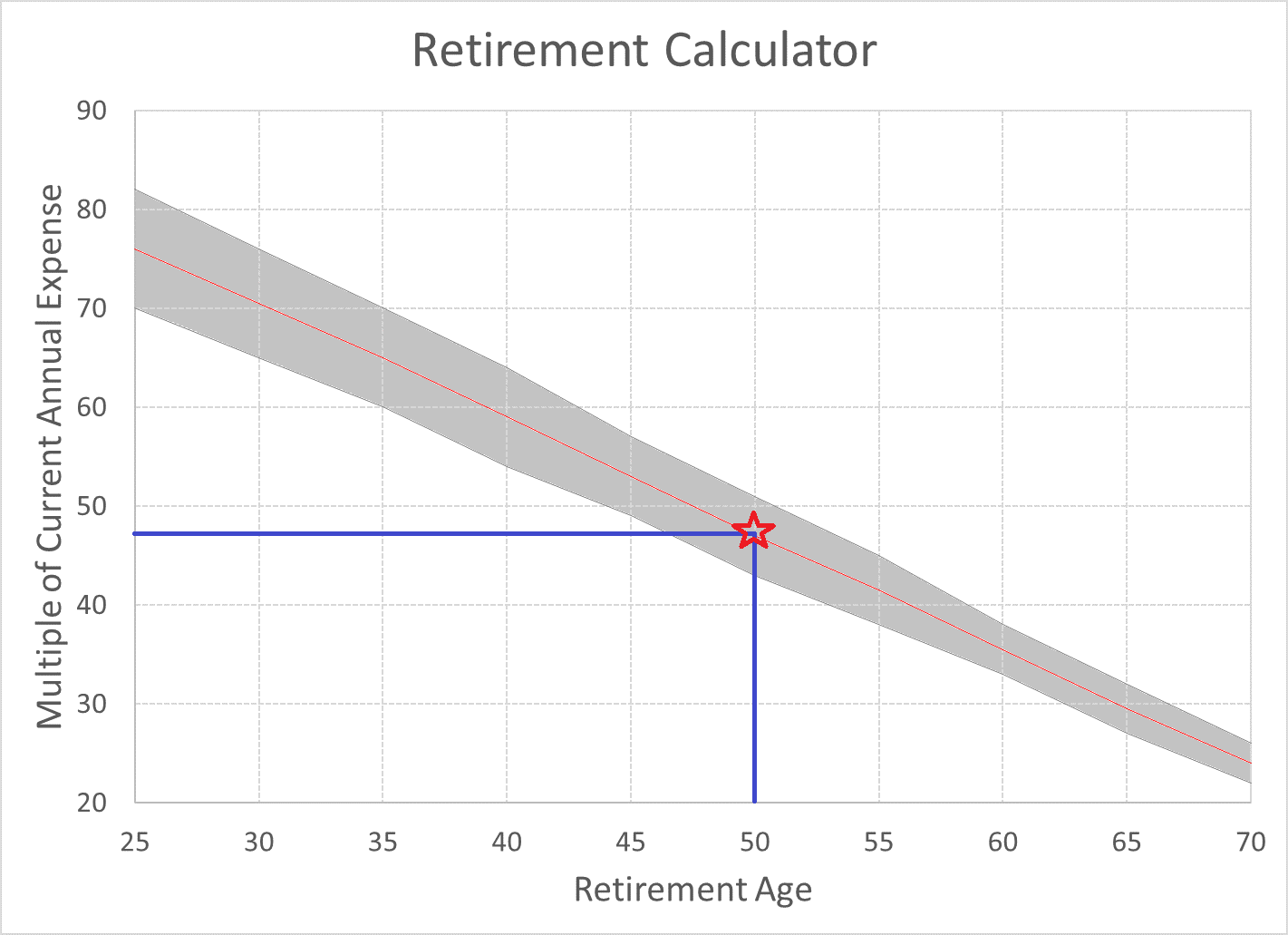

From the preceding paragraphs it may be noticed that we have allowed for two inputs to be decided by the prospective retiree – Input 1 : Age of Retirement and Input 2 : Years of forward expenses to be locked-in debt. The other variables such as life expectancy (90y), Inflation (6%), Debt return (3.5%), Equity return (10%) are fixed. We also present our calculated results of the required corpus as a multiple of current expenses. We now have all the required inputs. Let us see how this looks in the graph below:

The graph above has the retirement age on the x-axis and the corpus required expressed as a multiple of annual expenses on the y-axis. The red trend line shows the relationship between retirement age and corpus required at retirement (expressed as a multiple of annual expenses). For example a 50 year old prospective retiree would require about 48x his annual expenses as a starting corpus to retire. If his annual expenses are Rs 50 lakhs it would mean he would require to have a corpus of 48 times that ie Rs 48 X 50 lakhs = Rs 2400 lakhs or Rs 24 cr. The grey band around the red line indicates the range of the multiple based on the retiree's choice of portfolio. If the retiree were to adopt a higher exposure to equity in his portfolio with say only 5 years of forward expenses locked in debt then he may chose a multiple on the lower rung of the grey band. On the other hand if the retiree is very risk averse and wishes to lock in 15 years of forward expenses in equity he must look at the upper rung of the grey band for getting his multiple.

We started this blog with reference to a piece on the internet claiming that a corpus multiple of 30x annual expense is a requirement to retire. One can see that this holds true only when a person retires at age 65. Retirement calculations are complex and require a host of assumptions which do not necessarily hold true over the period of interest. Nevertheless, we have attempted here to provide a conservative retirement reckoner. It provides a simple thumb-rule based on retirement age to determine how many times current expense a retiree needs to have built up as a corpus. It goes without saying - the usual disclaimers apply. Individual circumstances in retirement will vary - while this may be a first cut, a more detailed approach is recommended on a case by case basis.

-

a)At what age is retirement expected ?

b)Till what age does the retiree expect to live?

c)What are the expected expenses of the retiree in retirement ?

d)What are the inflationary expectations over the retirement horizon ?

e)What are the retirement portfolio risk-return assumptions (% allocation to risky assets)

Age at Retirement and Life Expectancy:

To be conservative it may be appropriate to assume the individual lives till age 90 irrespective of health. We will allow the age of retirement to be kept as a variable to be toggled with for the prospective retiree.

Expenses in Retirement:

The answer to question (c) is complex. A 50 year old retiree may wish to build in expenses for travel and eating out and may underestimate medical costs which creep in later in life. On the other hand an older retiree may not wish to travel but also have higher medical expenses. We feel the answer to this question is prudently answered closer to retirement rather than much earlier – simply because circumstances and people change. One can circumvent this problem by trying to answer the question every year – ie what are my current annual expenses ? – at my current annual expenses and my current age, do I have a corpus that is sufficient for me to retire today?

Inflation:

Question (d) on inflation is not trivial. Inflation has a huge impact on projecting future expenses. A reduction in inflation assumption from 6% to 2% drops expenses 30 years into the future to 1/3rd !! As future expenses are significantly impacted by inflation, a prudent approach would be to assume inflation in India at 6% - which is the upper limit for the 2% to 6% inflation target band given to the Reserve Bank of India. This is not to say that the RBI’s independence from the Government of India can be taken for granted nor should it be assumed that the RBI will always have enough arsenal in its reserves to keep a tab on inflation within this band. 6% though conservative should be taken with a bit of salt.

Risk-Return assumptions of the Retirement Portfolio:

Question (e) on the risk-return assumptions of the retirement portfolio are intimately connected with two further questions –(1) return expectation on debt and equity and (2) what mix of debt and equity the retirement portfolio will have. To answer question 1, we turn to the current macro-economic conditions in India. A curious case of negative real returns for debt investments post tax exists today. A one year bank fixed deposit for an individual in the highest tax bracket would yield about 3.5% interest post tax - a full 2.5% below current inflation. It may be argued that yield on debt investments can be increased by purchasing lower rated debt paper – however this assumes taking on credit risk entering uncomfortable territory. Yield could also be pushed up by buying long duration sovereign paper – however mark to market risks can be high in long duration paper due to interest rate fluctuations. It may also be argued that the current scenario of negative real returns on debt may not last for long. Our approach is nevertheless to err on the side of caution and assume a debt return of 3.5% post tax. Our assumption for equity returns is based on the assumption that the long term growth rate of the Indian economy will be 6% + 6% inflation – which would bring equity returns to 12%. We shave off 1% for taxes and keep a further cushion of 1% - making our assumption on returns in equity at 10%.

To obtain the overall return of the retirement portfolio – it is required to establish what mix of debt and equity the retirement portfolio is to have. Higher debt allocation makes the portfolio safer – however long term returns get affected since debt returns are just 3.5%. Equity returns ensure a higher long term return of 10% which however come with significant drawdown risks in the short term - making the overall portfolio riskier. It is also likely that the mix of equity and debt will not be constant through the lifetime of the corpus. How then do we judiciously allocate between equity and debt through the lifetime of the retirement corpus? Retirement portfolios face two risks – the first risk is the inability of the corpus to last over the lifetime of the retiree and the second is the short-term mark to market fluctuations in the portfolio due to drawdowns in risky equity. It is clear that the % allocation to equity is unlikely to remain the same over the life of the retirement corpus. It is more likely that exposure to equity would initially be higher and then would taper down as the retiree age nears 90. We feel a more intuitive way to tackle this issue is to a-priori decide how many years of forward expenses the retiree wants to lock into debt. A very risk averse retiree may want to lock-in 15 years of forward expenses in debt while a more adventurous retiree may feel comfortable with only 5 years of forward expenses in debt. Do note that there is a trade-off – the more years of forward expenses locked in safe debt investments gives lesser room for exposure to equity – reducing long term returns and hence the overall return expectations of the portfolio – and thereby dropping the maximum term over which the retirement corpus can last. The number of years of forward expenses to be locked into debt is a personal choice to be made by each retiree. We will allow for this personal choice by providing a range. The retiree can chose where he wishes to be in this range.

Solving the retirement problem:

From the preceding paragraphs it may be noticed that we have allowed for two inputs to be decided by the prospective retiree – Input 1 : Age of Retirement and Input 2 : Years of forward expenses to be locked-in debt. The other variables such as life expectancy (90y), Inflation (6%), Debt return (3.5%), Equity return (10%) are fixed. We also present our calculated results of the required corpus as a multiple of current expenses. We now have all the required inputs. Let us see how this looks in the graph below:

The graph above has the retirement age on the x-axis and the corpus required expressed as a multiple of annual expenses on the y-axis. The red trend line shows the relationship between retirement age and corpus required at retirement (expressed as a multiple of annual expenses). For example a 50 year old prospective retiree would require about 48x his annual expenses as a starting corpus to retire. If his annual expenses are Rs 50 lakhs it would mean he would require to have a corpus of 48 times that ie Rs 48 X 50 lakhs = Rs 2400 lakhs or Rs 24 cr. The grey band around the red line indicates the range of the multiple based on the retiree's choice of portfolio. If the retiree were to adopt a higher exposure to equity in his portfolio with say only 5 years of forward expenses locked in debt then he may chose a multiple on the lower rung of the grey band. On the other hand if the retiree is very risk averse and wishes to lock in 15 years of forward expenses in equity he must look at the upper rung of the grey band for getting his multiple.

We started this blog with reference to a piece on the internet claiming that a corpus multiple of 30x annual expense is a requirement to retire. One can see that this holds true only when a person retires at age 65. Retirement calculations are complex and require a host of assumptions which do not necessarily hold true over the period of interest. Nevertheless, we have attempted here to provide a conservative retirement reckoner. It provides a simple thumb-rule based on retirement age to determine how many times current expense a retiree needs to have built up as a corpus. It goes without saying - the usual disclaimers apply. Individual circumstances in retirement will vary - while this may be a first cut, a more detailed approach is recommended on a case by case basis.