The time value of money is an Investment 1.0 topic. It is a fundamental attribute that capital today is more valuable than the same notional amount of capital anytime into the future. In other words capital of the future will need to be discounted at a specified rate to today’s value. This fundamental attribute however escapes the novice investor’s thought processes. Further, many a salesman of financial products (particularly insurance products) leverages our inability to grasp the concept of time value of money and is able to market costlier products to investors.

A few days ago, I was approached by an insurance company representative regarding my term insurance policy. It was a pure term policy that had 30 years of term remaining on which I was paying a flat premium over the entire term. The salesperson informed me that the company had come out with a limited pay option on the same term policy that will allow me to pay premium for a shortened period of time while receiving term cover for the entire remainder 30 years of the policy . It was further marketed to me that while my original full term pay policy required me to pay 1.26 lakh Rs per annum of premium for 30 years, the limited pay option required me to pay 2.91 lakh Rs per annum for a limited time of 10 years. The total premium I would be paying on my original policy would be 37.80 lakh Rs (i.e 1.26 lakh Rs for 30 years) and the total premium I would be paying for the limited pay option would be significantly lower at 29.10 lakh Rs. A straight saving of 23% savings or 8.70 lakh Rs savings !! - incredible indeed and any novice investor would jump at the idea of saving such a large amount. But then hold on – and think again…

When comparing two streams of cash flows, it is important that the notional future cash flow amounts not be simply added, but in-fact the cash flows of the future be discounted at a suitable rate and then added. In other words it is like saying, if I were to start a Fixed Deposit today to fund the cash flow requirements of each of these options, what would be the amount I would need to put aside for each. Obviously the option which requires a lower amount, will be the cheaper and better policy (of-course for identical policy benefits). What is this discounting procedure? Let us digress and take a few paragraphs to illustrate:

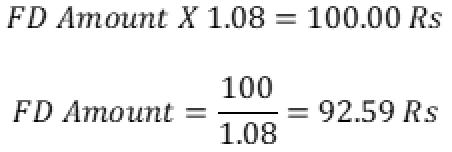

Lets start with say 100 Rs today versus 100 Rs one year from today. The 100 Rs of today is valued at 100 Rs. But what is today’s value of 100 Rs one year from today ? This is calculated by assuming we put a certain amount in a very low risk investment (Fixed Deposit) to generate 100 Rs one year from today. If we assume the interest rate of the Fixed Deposit is 8%, then :

In other words 100 Rs one year from today is worth only 92.59 Rs today. Let us now calculate the today’s value of 100 Rs two years from today:

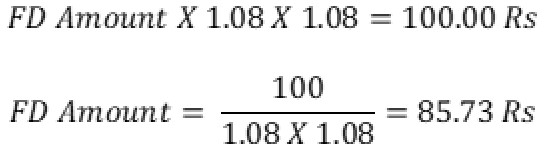

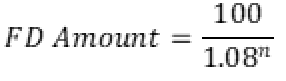

The value of 100 Rs today, two years from today, amounts to 85.73 Rs. In a similar fashion the value of 100 Rs, n years from today will be :

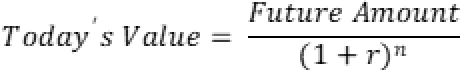

To generalize further, any future amount n years later discounted at an interest rate of r to today’s value, will be :

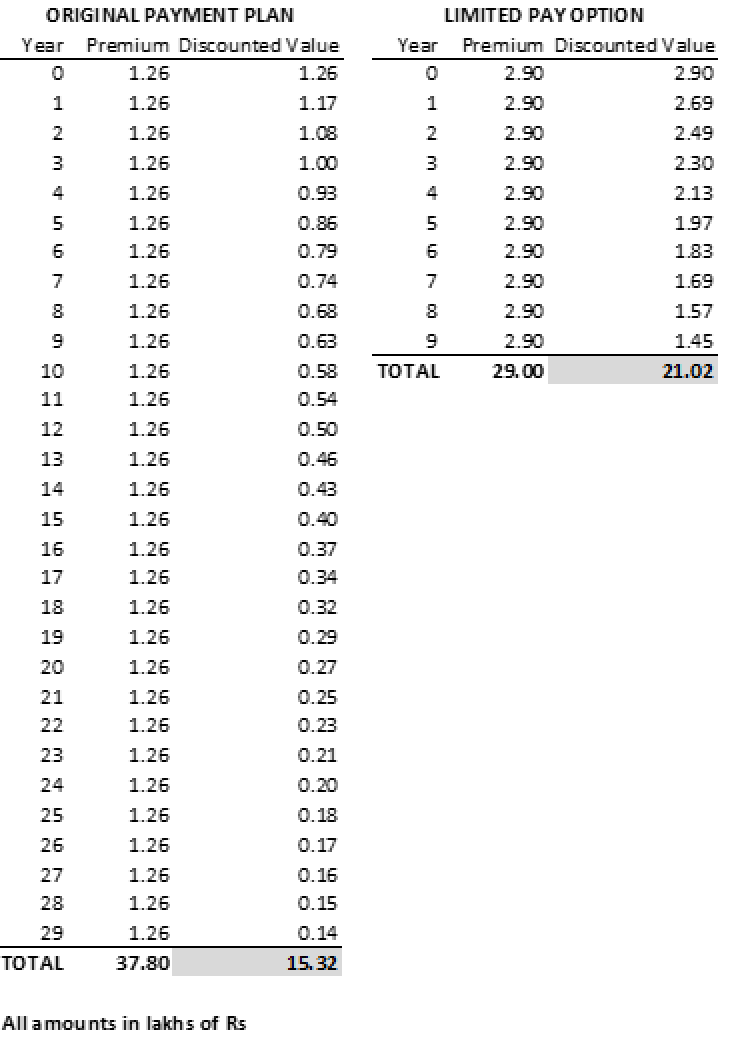

Coming back to comparing the proposal of the insurance sales representative, two tables are constructed below illustrating the discounted value of the future cash flows required for paying the premiums in both the options offered:

It is seen in the above two tables that although the notional amount of 37.80 lakh Rs in the full term pay option is higher than 29.00 lakh Rs under the limited pay option, the sum of the discounted cash flows is clearly the other way around. In other words the full pay option needs to keep aside an FD amount of only 15.32 lakh Rs today at 8% interest to fund the future premiums versus the limited pay option requires an FD amount of 21.02 lakh Rs to fund its premiums. The reason for the diametrically opposite results in the two cases is primarily because the distant future cash flows under the original full term payment plan get discounted to very small values. For example 1.26 lakh Rs 29 years from today is only 14,000 Rs in today’s value. Discounting future cash flows may seem trivial for many. But there are an equal number if not more who do not take this into account when comparing investment options of varying future cash flows. It is evident that this is true from the many marketing gimmicks such as these that are put for consideration, that there exists a market of investors who are blind to the discounting of future cash flows.

As expected I told the sales person that I will stick to my original full term payment plan.